A New Year, A New Opportunity to Save with a 529 Plan

The start of a new year is typically a time when people resolve to implement or recommit themselves to a personal financial goal. This year, why not consider opening a 529 plan account, or increasing your contributions to an existing account, to enhance your child’s or grandchild’s financial future? 529 plans are the most flexible they’ve ever been since their creation more than 25 years ago.

A college fund...and more

Education, in any form, can be a key life building block. A 529 plan is specifically designed for education savings. The main benefit of a 529 plan is tax related: earnings in a 529 account accumulate tax-deferred and are tax-free when withdrawn (which could be many years down the road) if the funds are used to pay qualified education expenses. Some states may also offer a tax deduction for contributions. For withdrawals not used for qualified education expenses, the earnings portion is subject to income tax and a 10% penalty.

In recent years, Congress has expanded the list of expenses that count as “qualified” for 529 plans. Here are some common expenses that qualify:

- Tuition and fees — up to the full cost of college/graduate school, vocational/trade school, and apprenticeship programs (schools must be accredited by Department of Education and courses can be online); up to $10,000 per year for K–12

- Housing and food (room and board) — for college/graduate school only, provided the student is enrolled at least half time

- Computers, required software, internet access, books, supplies — for college/graduate school only

- Paying student loans — up to $10,000 lifetime limit

In addition, starting in 2024, families who have extra funds in their 529 account can roll over up to $35,000 to a Roth IRA in the beneficiary’s name, subject to annual Roth IRA contribution limits.

Automatic contributions...and more

Sure, you could build an education fund outside of a 529 plan, but the tax advantages of 529 plans are hard to beat. Plus, 529 plans offer other benefits:

- The ability to set up automatic, recurring contributions from your checking or savings account, which automates your effort and allows you to save during all types of market conditions

- The flexibility to increase, decrease, or temporarily stop your recurring contributions, or to make an unscheduled lump-sum contribution, that reflects the ebbs and flows of your financial situation

- The option to choose a mix of investments based on the age of the beneficiary, where account allocations become more conservative as the time for college gets closer

- A separate account from your regular checking, savings, or brokerage account, which may reduce the temptation to dip into it for a non-education purpose

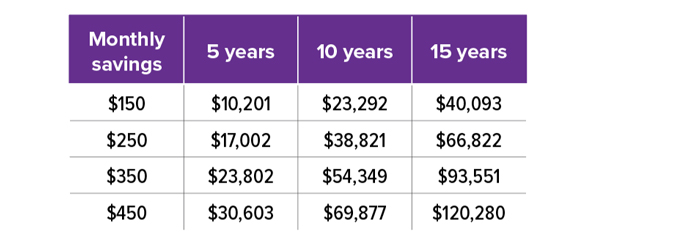

Building an Education Fund

Table assumes an annual 5% return. This is a hypothetical example of mathematical principles and is not intended to reflect the actual performance of any investment. Rates of return will vary over time, particularly for long-term investments. Investments with the potential for higher rates of return also carry a greater degree of risk of loss. Fees and expenses are not considered and would reduce the performance shown if they were included.

How to open a 529 account

To open a 529 savings account, select a 529 plan and fill out an application online. You will need to provide personal information, name a beneficiary, choose your investment option(s), and set up automatic contributions or make an initial one-time contribution.

There are generally fees and expenses associated with participation in a 529 plan. There is also the risk that the investments may lose money or not perform well enough to cover college costs as anticipated. The tax implications of a 529 plan should be discussed with your legal and/or tax professionals because they can vary significantly from state to state. Most states offering their own 529 plans may provide advantages and benefits exclusively for their residents and taxpayers, which may include financial aid, scholarship funds, and protection from creditors. Before investing in a 529 plan, consider the investment objectives, risks, charges, and expenses, which are available in the issuer’s official statement and should be read carefully. The official disclosure statements and applicable prospectuses, which contain this and other information about the investment options, underlying investments, and investment company, can be obtained by contacting your financial professional.