SECURE 2.0: Big Impact for Small Businesses

A recent AARP study found that nearly half of all private sector employees ages 18 to 64 had no access to a retirement plan at work. It also found that small businesses are more likely to lack a work-based plan, putting their workers at a significant disadvantage when it comes to retirement preparations.1

Last December, Congress passed a $1.7 trillion omnibus package that included the SECURE 2.0 Act of 2022, a package of legislation designed to improve the nation’s retirement-planning health.* Here are a few provisions that may be of particular interest to small business owners.

Tax Perks for Employers

Beyond the obvious benefits for employees, providing access to a retirement plan might also help a small business build and retain a quality staff. To that aim, the Act enhances the tax credits offered for the adoption of new retirement plans, beginning in 2023.

For employers with 50 employees or less, the pension plan start-up tax credit increases from 50% of qualified start-up costs to 100%. Employers with 51 to 100 employees will still be eligible for the 50% credit. In both cases, the credit maximum is $5,000 per year (based on the number of employees) for the first three years the plan is in effect. In addition, the Act offers a tax credit for employer contributions to employee accounts for the first five tax years of the plan’s existence. The credit amount is a maximum of $1,000 per participant, and for each year, a specific percentage applies. In years one and two, employers receive 100% of the credit; in year three, 75%; in year four, 50%; and in year five, 25%. The amount of the credit is reduced for employers with 51 to 100 employees and is not available to employers with more than 100 workers.

More Rule Changes Ahead

Beginning in 2024, employers will be able to adopt a starter 401(k) or similar 403(b) plan, which is designed to be lower cost and easier to administer than other types of employer-sponsored plans. This type of auto-enrollment plan will be for employee contributions only, up to a maximum of $6,000 per year ($7,000 for those 50 and older), indexed for inflation.

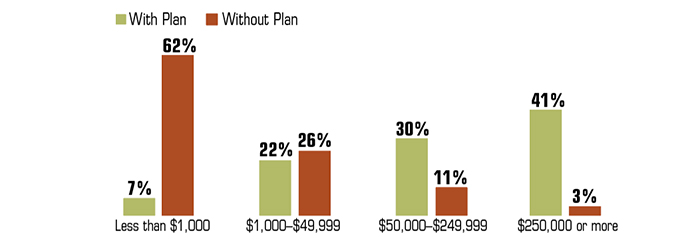

Comparing Workers’ Savings: With Retirement Plan vs. Without

Source: Employee Benefit Research Institute, 2022. Retirement plans include defined contribution plans, defined benefit plans, and IRAs. Numbers may not add up to 100% due to rounding.

SIMPLE plans may benefit from two new contribution rules that take effect in 2024. First, employers may make nonelective contributions to employee accounts up to 10% of compensation or $5,000. Second, the annual contribution limits (standard and catch-up) for employers with no more than 25 employees will increase by 10%, rather than the limit that would otherwise apply. An employer with 26 to 100 employees would be permitted to allow higher contributions if the employer makes either a matching contribution on the first 4% of compensation or a 3% nonelective contribution to all participants, whether they contribute or not.